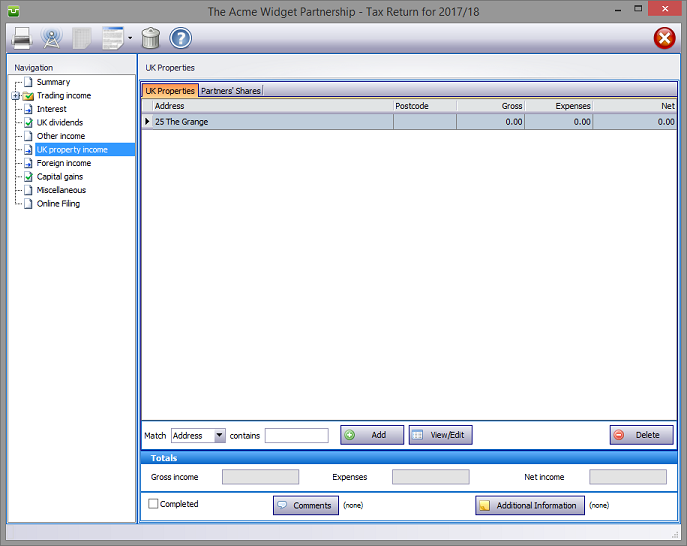

In the Navigation pane click on UK property income.

Please read the HMRC document sa801

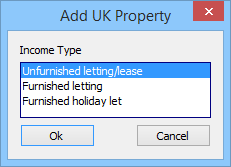

Next hit the Add button to select the type of income from property.

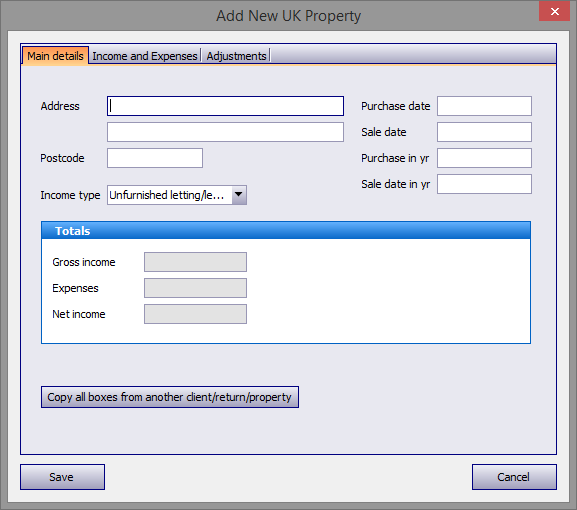

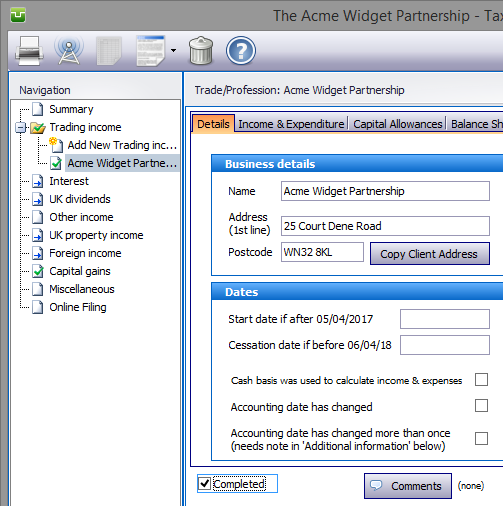

UK Property details

Select Income Type and hit the Ok button. Enter the property address etc. on the Main details tab and the income etc. via the Income and Expenses and Adjustments tabs.

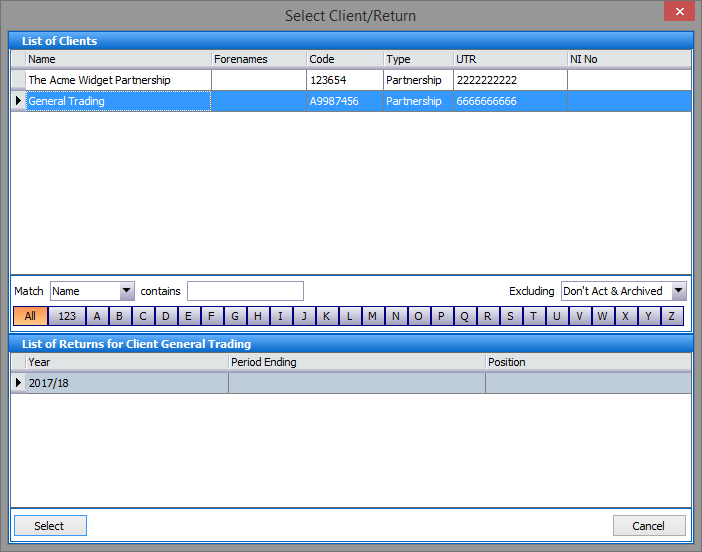

If the letting is with another client in your database you may avoid manually re-entering the data by clicking on the Copy all boxes etc. button. This takes you to the Select Client/Return screen, the upper part of which contains the same search facilities as List Clients; the lower area repeats the List Returns information.

Firstly, highlight the client and the tax year/return from which data is to be copied then click the Select button.

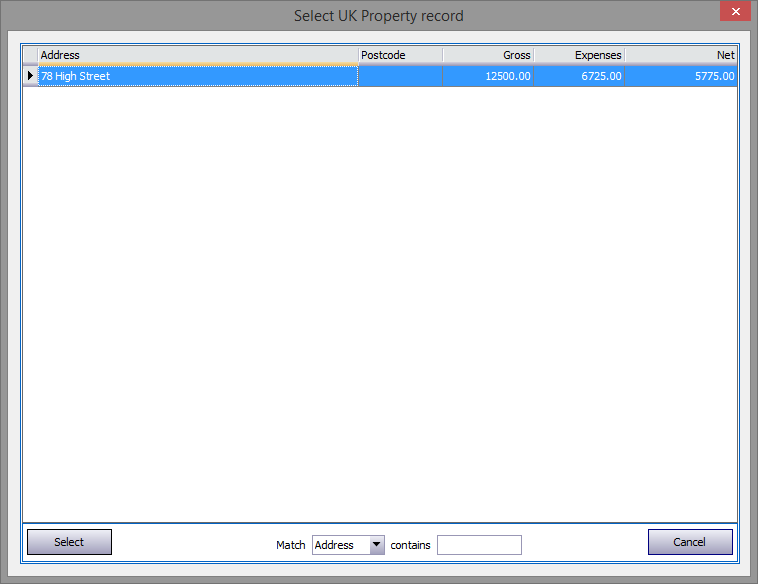

From the list of properties highlight, one by one, the properties you wish to copy and hit the Select button.

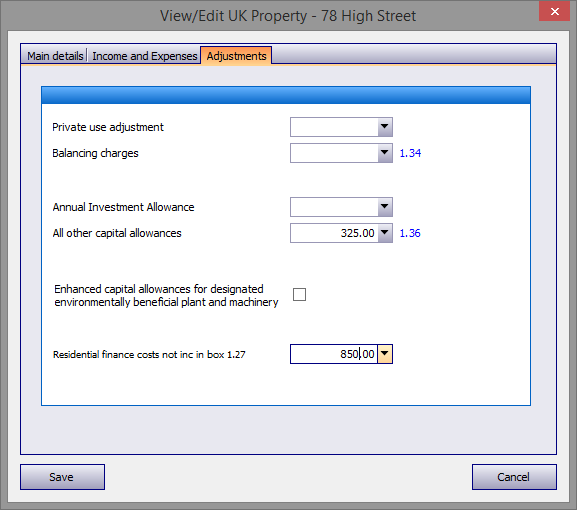

Since the program will duplicate all data, where the income etc. is not shared equally it will be necessary to manually make the necessary changes via the Income and Expenses and Adjustments tabs. Note the Residential finance costs not inc. in box 1.27 i.e. the disallowed interest excluded from the entries in the Income and Expenses section.

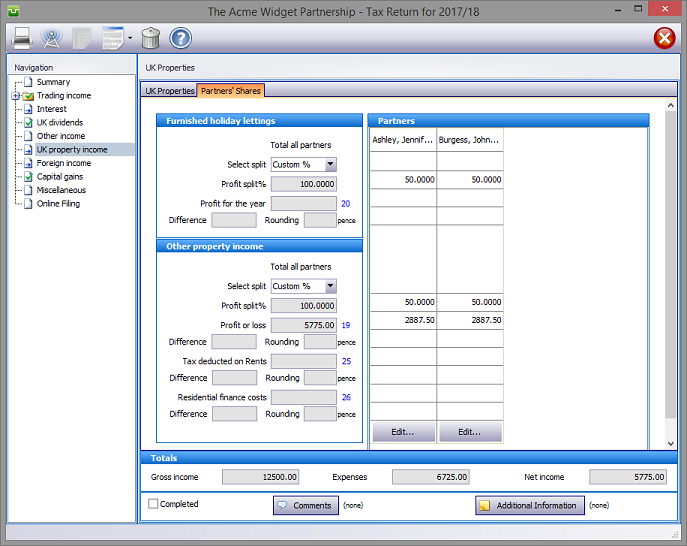

Partners' Shares

Before finishing this section it is necessary to allocate each partner's share of dividends etc.

Proceed by clicking on the Partners' Shares tab and select the percentage split using the drop down arrow to the right of the Select split box i.e. Custom %, As Trade % or Manual.

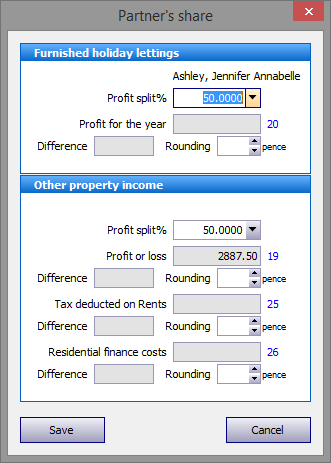

To set Custom % click on one of the Edit... buttons at the foot of the Partners screen and manually enter the Profit split percentages as appropriate.

Save your entries and continue entering information for the remaining partners.

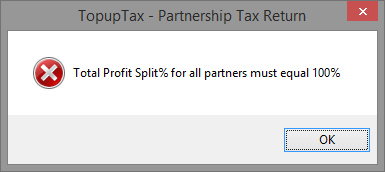

This screen warns if the Total Profit split percentage is incomplete. This must be addressed before the program can proceed further.

Rounding

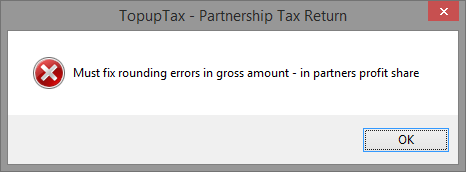

Where the quantum of Tax credits/Dividends etc. is not exactly divisible by the number of partners it is necessary to make a rounding adjustment.

This is effected by first selecting the partner whom you wish to receive the rounding adjustment then hit the Edit... button. The rounding necessary is usually a matter of one or a few pence and appears in the Difference box at the foot of the screen. Enter the amount needed in the Rounding box to the right of the Difference box. Finally click on the Save button.

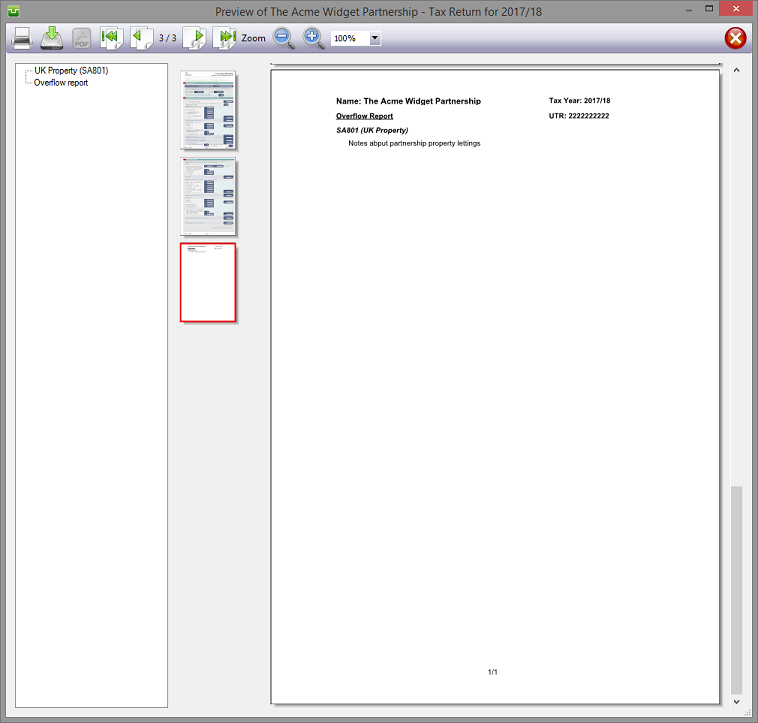

Entries made on the Additional Information tab will be printed as an Overflow Report to supplement form sa801 which forms part of the return. Entries made via Comments are for information only and do not appear on the return or the supplementary pages. The first few words of additional information/comments appear to the right of the relevant boxes.

Finishing

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

| Notes | Helpsheets |

| sa801-notes | hs251 |

Copyright © 2025 Topup Software Limited All rights reserved.